Pennsylvania Special Tax Forgiveness Credit: Do You Qualify?

JW

Last updated 03/21/2024 by

Jessica WalrackThe Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. It is designed to help individuals with a low income who didn’t withhold taxes throughout the year and those who are retired. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. To learn more about the PA tax forgiveness credit, how it works, and if you qualify, read this quick guide.

If you don’t qualify for tax relief under the Pennsylvania Tax Forgiveness Credit, find out if you qualify for an alternative tax relief program.

End Your IRS Tax Problems

Get a free consultation from a leading tax expert.

It's quick, easy and won’t cost you anything.

What is the PA tax forgiveness credit?

The Pennsylvania (PA) tax forgiveness credit helps eligible taxpayers reduce all or part of their tax liability to the state. In some cases, it will even give taxpayers a state income tax refund.

How does PA tax forgiveness work?

The amount of tax that is eligible to be forgiven depends on their filing status, the income level for the year, and the number of dependent children you have (if any). It ranges from 0% to 100%, in 10% increments.

The more dependent children you have and the less income you make, the higher the percentage of tax forgiveness you will qualify for.

For example, a single person with two children who makes $25,500 would qualify for 100% tax forgiveness, while a single person with one child who makes $18,250 would only be eligible for 10% tax forgiveness (source).

Who qualifies for PA tax forgiveness?

The Pennsylvania Department of Revenue reports that 20% of Pennsylvania households qualify for tax forgiveness on some level, so it’s worth checking to see if you are eligible.

What are the basic PA tax forgiveness qualifications?

To qualify for PA tax forgiveness, you must:

- Be subject to Pennsylvania state personal income tax.

- Not be dependent on another person’s federal tax return (an exception exists if you are a dependant of someone who qualifies for the PA tax forgiveness credit).

- Meet the eligibility income requirements.

If you meet the first two requirements, see the eligibility income requirements below.

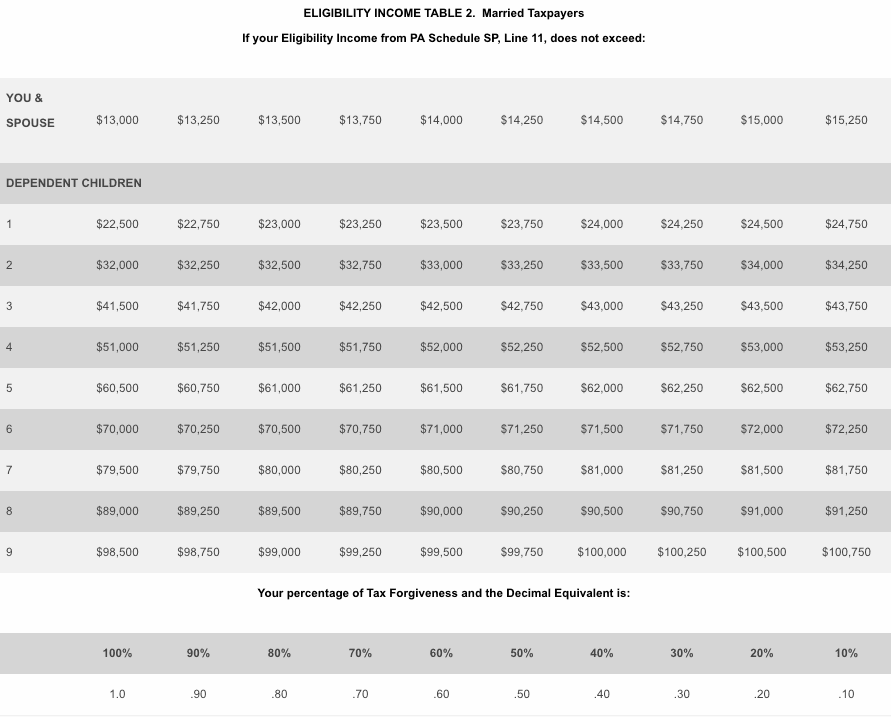

PA Schedule SP eligibility income tax tables

The PA Schedule SP eligibility income tables make it easy to see if you meet the requirements to get a tax credit.

To use the tables, follow these steps:

- Find the table that fits your filing status, married or unmarried.

- Look in the left-hand column for how many dependent children you have (if any).

- Follow that row to the right to find the amount of income you received during the year.

- If you find your income amount on the table, go straight down the column to the bottom for the percentage of tax forgiveness you qualify for.

For unmarried taxpayers:

For married taxpayers:

What does eligibility income include?

Keep in mind that eligibility income is different from taxable income. You must include income reported on your PA tax return AND any non-taxable income you have received during the year. This can include but is not limited to:

- Child support

- Gifts

- Awards

- Prizes

- Insurance payments

- Inheritances

- Lottery winnings

- Tax-exempt interest earnings or dividends

- Spousal support

- Alimony

Note, pension payments, unemployment, and social security income do not have to be included.

What table should you use if you and your spouse are separated?

If you and your spouse are separated as per a written agreement or have lived apart for more than six consecutive months, you should use the table for unmarried individuals.

How to file for Pennsylvania tax forgiveness

If you want to file for Pennsylvania tax forgiveness, you will need to file a personal income return in PA (PA-40) and will also need to complete the PA schedule SP form.

“To claim tax forgiveness, the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40, Individual Income Tax return. On PA-40 Schedule SP, the claimant or claimants must:

- Determine the amount of Pennsylvania-taxable income. A single or unmarried claimant determines only his or her own amount of taxable income. Married claimants must determine their own taxable income separately when filing separately.

- Specify the claimant’s status, single or married, for filing PA-40 Schedule SP.

- Provide the qualifying dependent or dependents that the claimant or claimants may report.

- Determine the amount of eligibility income by itemizing the amounts of nontaxable and non-reportable income that the claimant or claimants earned, received, or realized during the entire taxable year. Married claimants must report each spouse’s eligibility income, whether filing jointly or separately.

- Calculate the applicable eligibility income limitation table based on the type of filer, the number of qualifying dependents, and the eligibility income of the claimant or claimants.

- Determine the percentage and amount of forgiveness.

- Complete the PA-40, Individual Income Tax return.” (source)

If you have questions about the Pennsylvania tax forgiveness program, you can visit the Pennsylvania Department of Revenue’s online customer service center.

Additionally, you can call the following number about your taxes: 717-787-8201 and this number for your business taxes: 717-787-1064.

Get expert tax assistance

Just like filing taxes, you can file for tax assistance on your own. However, it can be hard to keep track of all the forms and details that come with tax time. If you’d like to hand over your taxes to a professional who can ensure you don’t miss any credits or deductions, consider hiring a tax preparation firm or paying for a software program that can guide you. Below we’ve curated a list of leading tax prep providers so you can easily review and compare your options side-by-side.

JW

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.

Share this post: