When Are Taxes Due In 2021? 2020 Tax Return Due Dates

JW

Last updated 04/01/2024 by

Jessica WalrackUpdate: The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The filing deadline for tax returns has been extended from April 15 to May 17th, 2021. If you are owed a refund file as quickly as possible. For those who can’t file by the May 17th, 2021 deadline, the IRS reminds individual taxpayers that everyone is eligible to request an extension to file their return.

Key takeaways of the IRS deadline extension:

|

Ah, tax time. It may not be your favorite time of year, but it’s a necessary evil. And being properly prepared can be the difference between a stressful, exhausting tax season and an efficient, effortless one. Want to be ready for the upcoming tax season? Read on to learn all the tax return due dates for the coming year.

Compare Tax Preparation Services

Compare multiple vetted providers. Discover your best option.

What are the tax return due dates for 2021?

You must submit your tax returns on time, or you’ll face penalties and interest on any amount owed. The due date depends on several factors, such as the type of return you’re filing, whether you are living in the U.S. or abroad, and whether you file an extension.

Below, find the various tax return due dates, assuming a tax year-end date of December 31:

- March 15, 2021: Due date for LLC, partnerships, and S-Corporations.

- April 15, 2021: Due date for corporations and individual tax returns. This deadline has been postponed to May 17, 2021 for individuals filing 2020 returns.

- May 15th, 2021: Due date for nonprofits and charities.

- June 15, 2021: Due date for individual filers who are out of the country.

- October 15, 2021: Due date for individual filers who request an extension.

If you are filing taxes for an organization with a tax year-end date that is not December 31st, your due date will adjust accordingly. For example, if the end date is three months earlier (September 31st), your due date would be three months earlier (January 15th).

As for extensions, it’s important to note that receiving an extension only delays the due date for paperwork, not for your taxes owed. Even if you file for an extension and your request is approved, you must still make estimated tax payments by April 15th. And you’ll still incur penalties and interest if you fail to do so.

If you are an individual living outside of the country, you may be automatically granted two extra months to file taxes and pay any amount due. If you would like a longer extension, you can get up to four additional months.

What are the estimated tax payment 2020 due dates?

If either of the following are true, you will need to make estimated tax payments each quarter throughout the tax year:

- You’re living on investment or self-employment income.

- You expect to earn more than $1,000 per year.

The due dates for estimated taxes in 2020 are (notice that the regular deadlines have been extended due to coronavirus):

- January 15th, 2021 (Fourth quarter payment for 2019 tax year).

- April 15th, 2021 (First quarter payment for 2020 tax year). The IRS has extended the deadline to July 15 due to the coronavirus pandemic.

- June 15th, 2021 (Second quarter payment for 2020 tax year).

- September 15th, 2021 (Third quarter payment tax year).

If you are required to make estimated tax payments and fail to do so (or if your estimated payments are too low), you’ll face an underestimated tax penalty. Based on the past three years, the average penalty is about 5% interest.

Want to avoid the fee? Then your estimated payments, overpayments carried over from the previous year, and withholdings must equal the amount of tax you owed in the previous year, or 90% of your current year’s tax.

What is the 2021 filing deadline for employers?

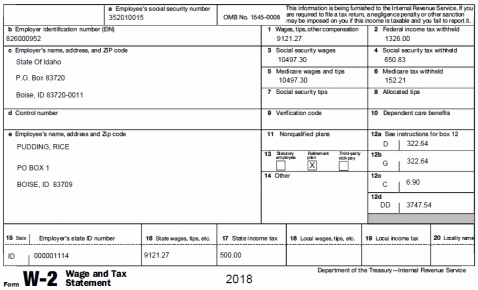

If you own a business and have employees, you will need to file their W-2 forms or 1099’s on time. The deadline was March 31, 2021, if done electronically. Otherwise the deadline was February 1, 2021.

What is the 2021 deadline to make IRA contributions?

You can make deductible (or non-deductible) contributions to your individual retirement accounts (IRAs), SEP-IRAs, SIMPLE IRAs, or solo self-employed 401(k)’s all the way through April 15th of the year following the tax year. In 2021, the due date was extended to May 17, 2021, so you have until then to contribute to your IRA.

Note that this is an exception to the law which requires that all payments included on a tax return be completed within the tax year at hand.

If any of the tax deadlines fall on a legal holiday, Saturday, or Sunday, the due date will be delayed to the next business day.

Need tax help?

While it is possible to navigate tax laws and deadlines on your own, having a well-trained professional and/or smart software on your side certainly helps. This is doubly true if your tax situation is complex.

If an issue does come up with a tax return, a tax preparer can handle it for you. They can speak to the IRS on your behalf and represent you as needed. Plus, it’s nice to rest easy knowing that your taxes are in (somebody else’s) good hands.

Want to review and compare leading tax preparation firms? Click here to find a list of leading companies complete with features, prices, and real-user reviews.

JW

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.

Share this post: