Routing Numbers: Everything You Need To Know

JW

Last updated 04/09/2024 by

Jessica Walrack Routing numbers have been integral to the banking industry for more than a century. They streamline the exchange of money, enabling you to set up a direct deposit or easily send money to a friend.Compare Options

Just as the rise of debit cards lowered the popularity of checks, wire transfers are now facing competition from digital money transfer services. So will routing numbers soon be a thing of the past?

Read on to learn everything you need to know. Plus, check out the new wave of alternative money transfer options available now.

Compare Checking Accounts

Compare checking accounts. Discover your best option.

What is a routing number?

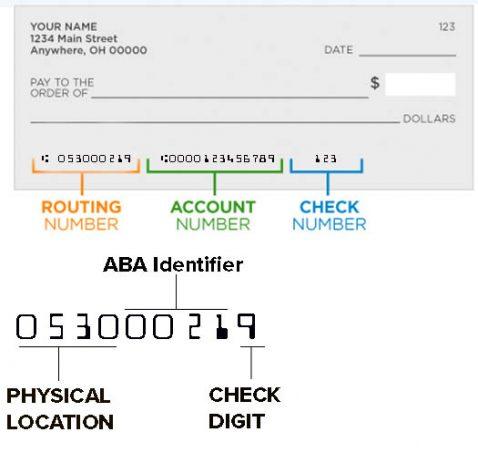

A routing number is a nine-digit number that identifies a U.S. financial institution in the context of money transfers. It’s more formally known as an American Bankers Association Routing Transit Number (ABA RTN).

This system was implemented back in 1910 as a way for the ABA to streamline the large scale circulation of paper checks. At the time, it was an alternative to the less reliable practice of identifying financial institutions by name alone.

Today, we use routing numbers for checks, wire transfers, and automated clearing house (ACH) transfers.

What do the numbers in a bank routing number mean?

Bank routing numbers may look random but they data the Federal Reserve uses for internal handling and information about the bank’s geographic location. Now you know why some banks have different routing numbers depending on where they are located. Here’s what each digit means using the routing number for Wells Fargo branches in North Carolina as an example: 053000219

Federal Reserve Routing Symbol

The first four digits “0530” tells you where the bank is located.

The first two digits “05” correspond to the 12 Federal Reserve Banks that represents the bank. In this case Richmond.

The two first digits range from:

- 1 to 12 for regular banks.

- 21 to 32 for credit unions and savings banks, although these numbers are no longer assigned to new institutions.

- 61 to 72 for Electronic Transfer Identifiers. These numbers are just the primary number plus 60.

| Primary | Credit Unions and Savings Banks | Electronic | Federal Reserve Bank |

|---|---|---|---|

| 01 | 21 | 61 | Boston |

| 02 | 22 | 62 | New York |

| 03 | 23 | 63 | Philadelphia |

| 04 | 24 | 64 | Cleveland |

| 05 | 25 | 65 | Richmond |

| 06 | 26 | 66 | Atlanta |

| 07 | 27 | 67 | Chicago |

| 08 | 28 | 68 | St. Louis |

| 09 | 29 | 69 | Minneapolis |

| 10 | 30 | 70 | Kansas City |

| 11 | 31 | 71 | Dallas |

| 12 | 32 | 72 | San Francisco |

The third digit “3 tells you which Federal Reserve check processing center was initially assigned to the bank. In this case, Philadelphia. However, processing is now performed at the Atlanta Federal Reserve Bank.

The fourth digit “0” tells you if the bank is located in the Federal Reserve city with a 0, or 1-9 according to which state in the Federal Reserve district it’s in.

ABA Institution Identifier

The next four numbers — the fifth through eighth digits — “0021” correspond to the bank’s unique ABA identity within it’s Fed district. If the ABA’s identity number has three numbers you add zeros in front to complete four digits.

Check digit

The ninth digit “0” is a check digit for a checksum test to ensure the routing number is valid. Financial institutions use this test to determine whether the routing number is valid. Here is how it works using our example: 053000219

- You take the 1st, 4th and 7th digit (0-0-2) and multiply them by 3 (0-0-6).

- You take the 2nd, 5th and 8th digit (5-0-1) and multiply them by 7 (45-0-7).

- Then you take the 3rd, 6th and 9th digits (3-0-9) and multiply them by 1 (3-0-9).

- Then you add all the resulting numbers: 6+45+7+3+9 = 70

The total should be divisible by 10 with no remainder (70/10=7). If it is — as in our example — it is a valid routing number.

When are bank routing numbers used?

Routing numbers facilitate everyday banking tasks like direct deposits, automatic bill payments, check processing, and wire transfers. Every financial institution is assigned a 9-digit routing number, which is used to identify a money transfer’s sender and recipient.

How do I find my routing number?

You can find it by looking at your checkbook! Alternatively, you can ask your bank or credit union, or search the ABA online database.

Checks

When you look at a check, you’ll see numbers printed across the bottom. The first number on the bottom left is the routing number.

To the right of the routing number is the account number. While routing numbers identify the financial institution in question, account numbers identify the specific account.

Both identification numbers are printed in an odd-looking font, known as magnetic ink character recognition (MICR). Each character produces a unique waveform which can be read quickly and easily by the MICR read head. This speeds up the processing time required for check deposits.

From financial institutions

If you don’t have checks on-hand, you can learn your routing number by contacting your financial institution. It’s often available in online banking systems, on an institution’s website, or your banking statements. Failing that, you can always learn it by calling customer support.

ABA search

Your third option is to check with the ABA. Just head to the ABA routing number lookup page online! There, you can look up two routing numbers per day and 10 per month.

Beware that a single institution can have multiple routing numbers. As such, it’s essential to confirm that the number you find is associated with the right bank.

Do routing numbers ever change?

Yes, they do occasionally change. Routing numbers can change when institutions merge, go through an acquisition, or consolidate. If this happens with your bank, you will typically receive a notification a few months in advance. Also, large banks with branches in multiple locations have different routing numbers depending on which branch you are referring to. For example, the table below shows the routing numbers for Wells Fargo.

The good news is that banks usually keep their old routing number active for some time after the change. This lets you use up any checks you have with the old number.

While you do usually have some time to update transfer information, it’s best to do it as soon as possible. Otherwise, you might inadvertently delay automatic deposits or withdrawals.

Is there a difference between ACH and ABA numbers?

Yes, there a difference between American’s Bankers Association (ABA) and Automated Clearing House (ACH) routing numbers. ABA routing numbers direct paper checks, while ACH routing numbers direct withdrawals and electronic transfers. However, most major institutions use the same number for both ABA and ACH purposes.

That said, some smaller regional institutions do have separate routing numbers for paper and electronic transfers. It’s worth investigating at your bank to make sure you’re using the right number for the right purpose.

What are the IBAN and Swift codes?

If routing numbers are only for domestic financial transactions within the U.S., what directs international transfers? That’s where the International Bank Account Number (IBAN) and Society for Worldwide Interbank Financial Telecommunication Bank Identifier Codes (SWIFT/BIC) come into play.

IBANs

The IBAN system became an international standard after its adoption by the European Committee for Banking Standards (ECBS). Now, over 100 countries use it (although the U.S. does not). It works by identifying bank accounts across borders and enabling international transactions with a reduced risk of errors.

IBANs can be up to 34 characters long and include a country code, two check digits, the domestic bank account number, a branch identifier, and possible routing information.

SWIFT/BIC codes

Over 212 countries (including the U.S.) and 10,000 financial institutions use SWIFT/BIC codes. These codes identify your financial institution and branch in an international transaction, just like routing numbers do in domestic transactions. They typically consist of eight to 11 characters, including a four-letter bank code, two-letter country code, two-letter location code, and two-digit branch code.

You can usually find your SWIFT code by asking your bank, checking your bank statement, or logging into your online banking system.

Both the SWIFT code and IBAN play important roles in international transactions. The U.S. currently uses SWIFT/BICs but not IBANs. However, you may run into IBANs when sending money to an international recipient.

Are ACH and wire transfers the same thing?

While similar, ACH and wire transfers are different. A wire transfer is a direct electronic transfer between institutions. An ACH transfer is an electronic transfer conducted by a third-party clearinghouse.

Wire transfers are generally faster and more secure but come with a fee. ACH transfers are often free, but they take a few days and offer less security.

Can someone hack my account with my routing number?

A hacker can’t access your financial account with just your routing number. They would also need your account number. However, if a hacker has both, they could set up automatic ACH withdrawals from your account.

Fortunately, hackers rarely target personal accounts. And if you do get targeted, consumer protection laws give you 60 days to report the fraud and recover your money.

How much do wire transfers cost?

The cost of wire transfers varies from one financial institution to the next. On average, it costs around $20 to $30 for a domestic outbound transfer and $45 to $50 for an international outbound transfer. On international transfers where the money is undergoing a conversion, you can also lose money on the exchange rate.

Secure money transfer alternatives

Nowadays, there are plenty of ways to transfer money without sharing your routing or account number. From online services to blockchain networks to cash services, there is no shortage of money transfer services. Paypal and Venmo are popular domestic money transfer services, while TransferWise has earned itself a reputation for affordable international transfers.

Would you like to keep your bank details secure and cut costs when transferring funds? Check out the money transfer services below to find the right service for your needs.

JW

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.

Share this post: